annual gift tax exclusion 2022 irs

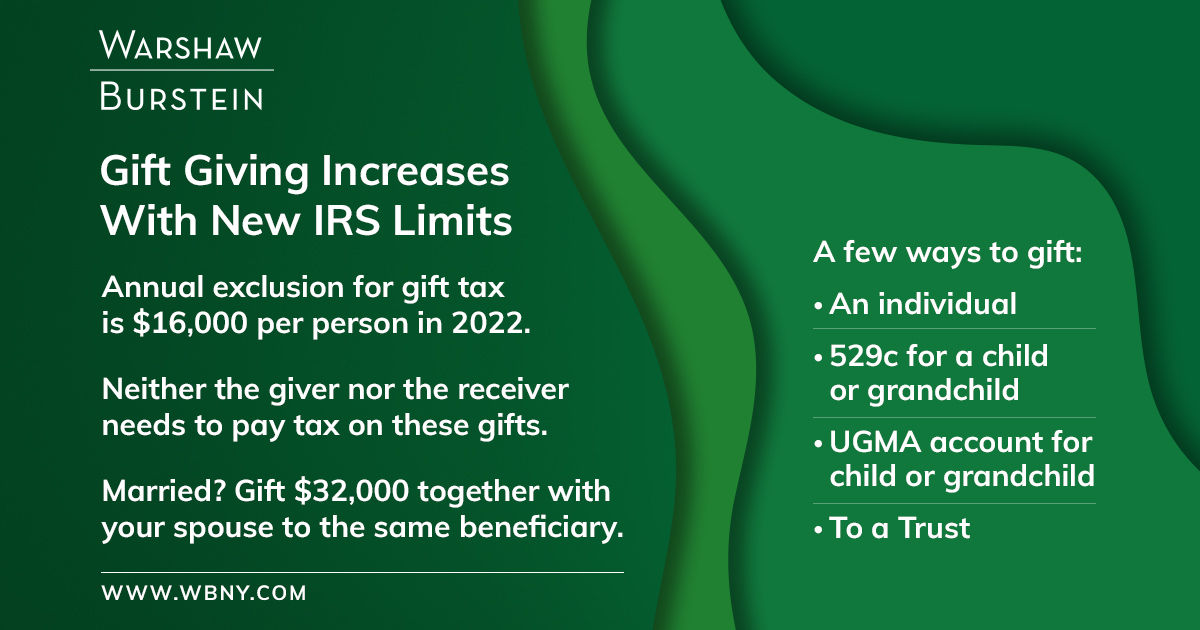

For 2022 the annual gift exclusion is being increased to 16000. The IRS recently released Revenue Procedure 2021-45 announcing the tax year 2022 annual inflation adjustments.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

In recently issued Revenue Procedure 2021-45 the IRS announced calendar year 2022 increases to the federal estate and gift tax exemption and to the gift tax annual.

. Anything above the gift tax annual. Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 15000 for gifts. The right of withdrawal is generally limited to an amount equal to the applicable annual gift tax exclusion.

The exclusion will be 17000 per recipient for 2023the highest exclusion amount ever. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. A separate annual tax exemption for gifts to non-citizens is increased to 164000.

The IRS released Revenue Procedure 2021-45 which announces the increase in 2022 of the estate gift and generation-skipping transfer tax applicable exclusion amounts. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021.

As a result the IRS increased the annual gift tax exclusion from 15000 to 16000 for 2022. The annual gift exclusion is applied to. Starting in 2023 individuals can transfer up to 1292 million to heirs during life or at death without triggering a federal estate-tax bill up from 1206 million this year.

In Revenue Procedure 2021-45 the IRS announced its inflation adjustments to key figures for the calendar year 2022. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. In 2018 2019 2020 and 2021 the annual.

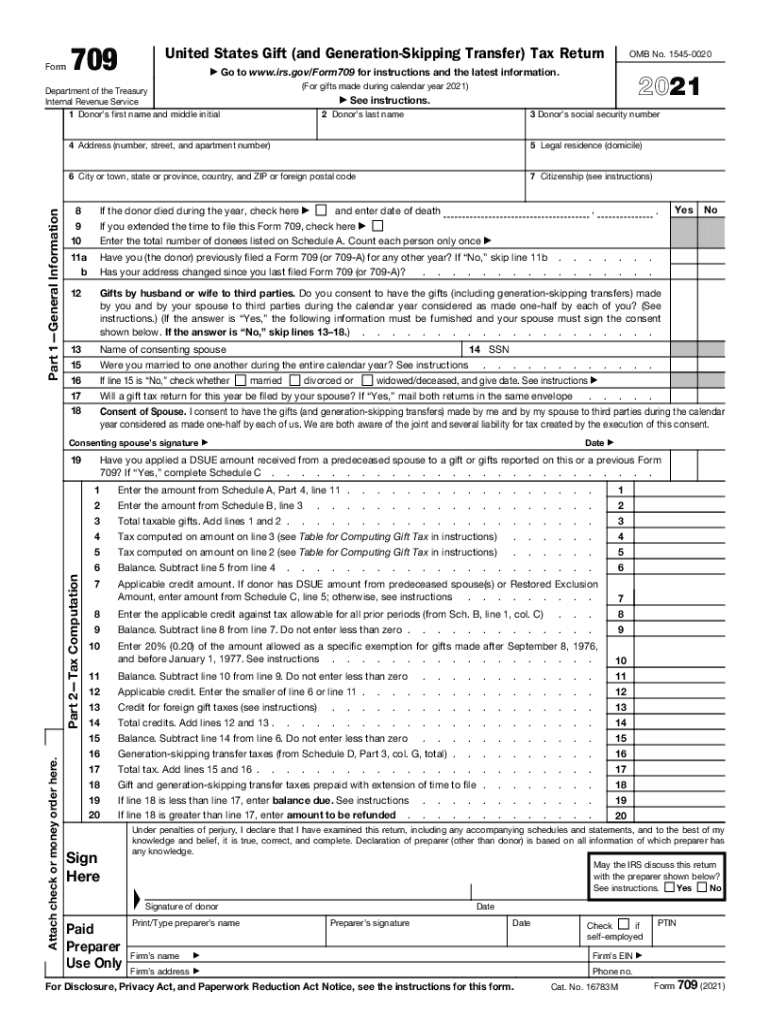

For Estate Tax returns after 12311976 Line 4 of Form 706 United States Estate and Generation-Skipping Transfer Tax Return PDF lists the cumulative amount of adjusted taxable gifts within. Procedure 2021-45 details more than 60 tax provisions. For the past four years the annual gift exclusion has been 15000.

This is the first increase to the annual gift tax. Itll also limit the donor to 20000 annual exclusion. Gift Tax Limit 2022.

This exemption is per. This increase means that a married. Further the annual amount that one may give to a spouse who is not a US citizen will.

For the first time in several years the annual. In 2022 you can give 16000. Annual Gift Exclusion.

That means you can give up to 1206 million without owing any gift tax. Now that you are aware of the gift tax limit for 2022 you know that your gift limit per recipient is a value of under 16000. In 2018 2019 2020 and 2021 the annual exclusion is 15000.

The annual part of the exclusion means you could gift 15000 on December 31 and another 16000 on January 1 without incurring tax because. It hit a 31-year high in October. The tax applies whether or not the donor intends the transfer to be a gift.

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

Gift Tax Limit 2022 How Much Can You Gift Smartasset

New Estate And Gift Tax Laws For 2022 Youtube

How Does The Gift Tax Work Personal Finance Club

March 4 2021 Trusts Estates Group News Key 2021 Wealth Transfer Tax Numbers

Warshaw Burstein On Twitter Gift Giving Increases With New Irs Limits The Annual Exclusion For Gift Tax Is 16 000 Per Person In 2022 There Are A Few Ways To Gift Where Neither

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Estate Planning Ohio Agricultural Law Blog

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

709 Form Fill Out Sign Online Dochub

Gift Planning In 2022 Stoel Rives Llp Jdsupra

2022 Annual Gift Tax And Estate Tax Exclusions Increase

2023 Irs Contribution Limits And Tax Rates

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free